Discovering an unfamiliar charge on your credit card can be perplexing. ‘What is this charge on my credit card?’—that’s the question we’ll help you answer. In a few simple steps, we’ll show you how to identify the charge and what actions to take, without overwhelming you with unnecessary details.

Key Takeaways

Unfamiliar charges on credit card statements can be due to merchant naming conventions, common credit card fees, or errors, and should be reviewed. A charge may be resolved by verifying with joint account holders or through investigation and online searches for merchant information.

Unauthorized charges must be reported to the credit card issuer immediately to limit liability, freeze the account, issue a replacement, and ensure resolution within two billing cycles, as provided by the Fair Credit Billing Act protections.

Preventive measures include regular monitoring of account statements, using secure methods for online transactions, and setting up alerts for any credit card activity to avoid unauthorized charges and maintain a secure financial standing.

Deciphering Mysterious Charges on Your Credit Card Bill

Unfamiliar charges on your credit card bill can stem from several reasons. Here are some common explanations:

The merchant’s name might appear differently due to alternative trading names, location listing, or specific naming conventions.

Forgetfulness about a past purchase.

Common credit card fees like late payment or cash advance fees.

Errors from the credit card issuer.

Reviewing transactions from the same date can assist in identifying past purchases. Regularly tracking expenses can provide context and help you recognize transactions that initially appear unfamiliar. But what if the charge still doesn’t ring a bell? Let’s delve deeper into recognizing merchant names and abbreviations.

Recognizing Merchant Names and Abbreviations

Merchant names on your credit card statement can sometimes leave you scratching your head. The name you see might not match the one you’re familiar with due to various reasons, such as alternative trading names, location listing, or naming conventions required by merchant data standards.

A straightforward approach would be to search the merchant name online as it appears on your statement. It’s likely to reveal the identity of the merchant and provide clarity. If the name on the statement is still unclear, consider looking it up online to find out what parent company it’s related to.

If the mystery persists, you need to initiate appropriate steps.

Steps to Take When You Spot an Unfamiliar Transaction

Stumbling upon an unfamiliar transaction on your billing statement can be alarming. Rest assured, there are actions you can implement. The first thing you should do is report it to your credit card issuer as soon as possible. However, before you make that call, verify if the transaction is recognized by any joint account holders or authorized users. They might have initiated the charge.

Reporting a suspicious transaction can be done either online or by calling your issuer using the phone number provided on the back of your credit card. Be proactive; swift reporting of fraudulent charges can prevent further unauthorized spending and negative impacts on your credit score. If the charge remains unidentified, it’s time to delve into further investigation.

Investigating Unidentified Charges on Your Statement

Should an unrecognized charge persist, you must adopt an investigative approach. Online searches using the exact merchant name on the statement can reveal the identity of unfamiliar charges, providing additional details and contact information. Additionally, it’s prudent to review receipts and financial records around the date of the transaction to see if they give any insights.

Another reason for unrecognizable transactions could be annual fees. These fees only occur once a year and can easily be forgotten, leading to unexpected charges. Before drawing conclusions, it’s important to cross-check the transaction with authorized users to avoid mistaking it for an unauthorized transaction.

Verifying Transactions with Authorized Users

An unfamiliar charge can be clarified by checking with authorized users on your account to determine if they recognize it. This is a crucial step before moving forward with any dispute process involving an authorized user.

You can verify the legitimacy of a charge by contacting the merchant or by consulting with joint cardholders or authorized users linked to your credit card account. If your authorized users don’t recognize the transaction, it’s time to utilize online tools and statements.

Utilizing Online Tools and Statements

Staying updated with your online statements is key to effectively managing your credit card account. These can help track and monitor pending charges so that you can verify their origins. Pending charges are holds placed on a particular amount of your credit, and they may appear on your online statements, affecting your available balance by temporarily reducing the amount of credit you can access.

Keeping an eye on your online statements and using online banking tools can help you identify any unfamiliar charges, including those that are still pending. Now, what if the charge turns out to be unauthorized? Let’s discuss how to report it to the credit card issuer.

Reporting Unauthorized Charges to Your Credit Card Issuer

If an unauthorized charge does appear on your statement, it’s crucial to report it to your credit card issuer immediately to limit liability and commence the investigation into the suspected fraud. The card issuer may then:

Freeze or cancel the card

Issue a replacement

Confirm the receipt of your report within 30 days

Resolve the dispute within two billing cycles (no more than 90 days) from receipt of your letter.

For disputing the charge, follow these steps:

Submit a written dispute letter to the address mentioned for billing inquiries on your credit card statement.

It’s advisable to use certified mail with a return receipt requested to ensure confirmation of delivery.

But before you do, it’s important to understand your rights and protections.

Understanding Your Rights and Protections

As a cardholder, you have rights under the Fair Credit Billing Act (FCBA), enforced by the Federal Trade Commission, against unauthorized charges and billing errors. This means that if you report credit card fraud, you are liable for no more than $50. Additionally, during an investigation by the card issuer, the disputed amount does not have to be paid, and it cannot be sent to collections until the issue is resolved.

If the credit card dispute is denied, you have the right to appeal the decision with the issuer, file a complaint with consumer protection agencies, or dispute the information with credit bureaus. You also have the right to halt future payments on their credit card up to the day before they are due, and issuers are required to adhere to these requests. But what happens if fraudulent charges are left unresolved?

The Impact of Fraudulent Charges on Credit Scores

If a fraudulent charge goes unnoticed and unresolved, it can have a significant impact on your credit score. It is important to address fraudulent charges promptly to minimize any potential damage. Failure to identify and dispute fraudulent charges can result in adverse effects on your credit report and score.

Not reporting fraudulent charges in a timely manner can have long-term negative consequences on your credit score. Hence, constant monitoring of your account and swift action upon noticing any suspicious activity is vital. Speaking of which, let’s discuss how to prevent unauthorized use of your credit card.

Preventing Unauthorized Use of Your Credit Card

Prevention is always better than cure; this holds true for unauthorized use of your credit card as well. Here are some steps you can take to protect yourself:

Monthly monitoring of account statements is vital to identify any unfamiliar transactions.

Use a dedicated credit card for online purchases to facilitate easier detection of suspicious activity.

Enroll in fraud alerts from the credit card provider to receive immediate notification of each transaction and monitor unusual spending patterns.

By following these steps, you can help protect yourself from credit card fraud.

Regularly reviewing your credit reports enables early detection of unauthorized accounts or activities that suggest potential credit card fraud. But how do you protect your card information from falling into the wrong hands in the first place?

Safeguarding Your Card Information

A fundamental step in preventing unauthorized use of your credit card is securing your card information. Here are some ways to do this:

Opt-out of credit card contract terms to prevent issuers from sharing your account information with third parties.

Avoid clicking suspicious links.

Log into your accounts directly via a web browser to safeguard against phishing and smishing.

Use secure websites with ‘https’ in the URL when transmitting sensitive information to ensure an encrypted connection. Avoid using public Wi-Fi for credit card transactions to maintain the security of your card information. Lastly, create unique and complex passwords for online banking profiles to prevent unauthorized access.

To further protect your card information during online transactions, consider using virtual number services provided by credit card companies. Monitoring your account and setting alerts can also aid in preventing unauthorized use.

Monitoring Your Account and Setting Alerts

Establishing alerts for each transaction and personalized spending and security alerts facilitates immediate detection of anomalies and aids in managing credit card spending. Credit card alerts can assist you in quickly identifying any potential suspicious activity. By alerting you to charges, they help reduce the risk of missing something on your statement..

Opting into security features offered by credit card providers, such as transaction notifications and proactive monitoring for signs of fraud, can assist in safeguarding against unauthorized activity. Regularly monitoring your credit card statements online and scrutinizing them each month is crucial to verify all transactions are accurate and to identify any unauthorized charges or discrepancies.

Now, what should you do if you encounter a billing error or a dispute?

Resolving Billing Errors and Disputes

Should you encounter a billing error or a dispute, knowing how to resolve it is crucial. The first step is to determine if the unrecognized charge is from fraud or a simple error, which could be a merchant mistake or billing error. Investigate by Googling the merchant, and consulting any joint cardholders or authorized users.

Credit card companies must:

Acknowledge receipt of a billing error notice within 30 days

Resolve the dispute within two billing cycles or 90 days, whichever comes first

Customers are not required to pay the disputed amount or any associated interest and fees while the investigation is ongoing

If a charge is proven incorrect, it must be removed from the statement

If not, the credit card company must provide a written explanation justifying the accuracy of the charge

Supporting evidence, such as receipts or cancellation confirmations, is important to justify the inaccuracy of the disputed transaction.

But when should you contact the merchant directly?

When to Contact the Merchant Directly

It could be beneficial to contact the merchant directly before escalating the issue to your card issuer. This can sometimes resolve issues with unrecognized charges faster. If your credit card statement includes transactions that are not recognized by you, reaching out to the merchant is the initial step in rectifying the issue. This might simply be a result of a clerical mistake or an incorrect merchant name.

If you have been double billed or suspect a math error, it is best to contact the merchant directly and explain the issue to them. This will help to resolve the matter quickly and efficiently. Contacting the business directly is often the fastest way to resolve disputes with businesses regarding credit card charges. However, if this does not resolve the issue, it might be time to file a dispute with your card issuer.

Filing a Dispute with Your Card Issuer

If direct communication with the merchant does not resolve the issue, the next step would be to lodge a dispute with your card issuer. When disputing a billing error, you are not required to pay the disputed amount and the bank cannot engage in collection activities for that portion of the payment.

The bank must acknowledge a consumer’s written dispute within 30 days of receiving it, during the billing cycle in which the error occurred. If a billing error did occur, the bank is obligated to resolve the dispute following the investigation. While a billing dispute is being investigated, the bank cannot report negatively to credit bureaus regarding the disputed charge.

But what about those pesky multiple charges and subscriptions?

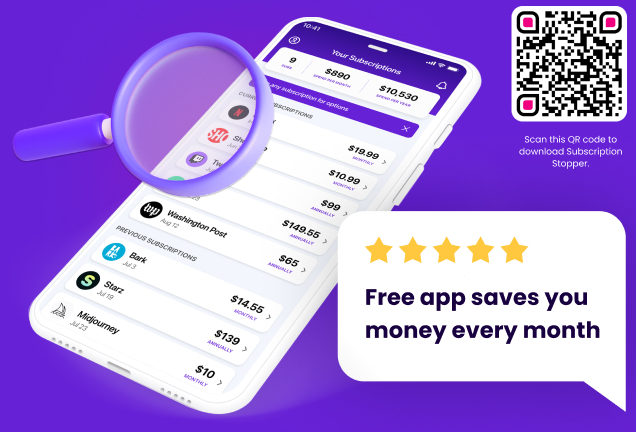

Navigating Multiple Charges and Subscriptions

Handling multiple charges and subscriptions can pose a challenge. Remember, to avoid further charges, cancel recurring payments at least three days before the next scheduled payment.

However, it’s crucial to remember that customers are still responsible for any services already received and may need to fulfill outstanding contractual obligations when canceling a subscription. While managing charges and subscriptions can be a bit of a hassle, optimizing your credit card use can help you avoid surprises.

Optimizing Credit Card Use to Avoid Surprises

You can avoid unforeseen situations by optimizing the use of your credit card. Here are some tips:

Pay off your credit card balance in full each month to avoid interest charges.

Keep your credit utilization ratio low by keeping your credit card balances low compared to your total credit limit.

This can help manage spending and maintain a good credit score.

Some tips for managing credit card usage effectively are:

Set a strict monthly spending limit on your credit card to ensure that the balance can be paid off each month, preventing interest charges.

Leverage rewards programs, such as cash back or points, to improve your financial health by reducing the credit card balance or saving on future purchases.

Read all terms and conditions on credit card offers to avoid surprises and disputes over undisclosed fees or automatic memberships.

Following these tips can help you manage your credit card usage effectively and avoid unnecessary fees or debt.

Summary

From deciphering unfamiliar charges, investigating unidentified transactions, reporting unauthorized charges, to preventing fraud, we have explored the many facets of managing credit card charges. By understanding your rights and protections, monitoring your account consistently, and maintaining responsible spending habits, you can effectively navigate the world of credit card charges and ensure your financial security. Remember, the key to managing your credit card effectively lies in vigilance, timely action, and smart spending habits.

Frequently Asked Questions

What should I do if I spot an unfamiliar transaction on my credit card statement?

If you spot an unfamiliar transaction on your credit card statement, report it to your credit card issuer without delay and check if the transaction is recognized by any joint account holders or authorized users. Don’t ignore this situation, as it is important to address it promptly.

How can I safeguard my card information?

To safeguard your card information, opt-out of credit card contract terms, use secure websites for transactions, avoid public Wi-Fi, and create unique passwords for online banking profiles. Using these precautions will help protect your financial information.

How can I optimize my credit card use to avoid surprises?

To avoid surprises, optimize your credit card use by paying off your balance in full each month, maintaining a low credit utilization ratio, setting a strict monthly spending limit, and leveraging rewards programs. Keeping these practices in mind will help you manage your credit card effectively.

What are my rights and protections against unauthorized charges and billing errors?

You are only liable for up to $50 under the Fair Credit Billing Act (FCBA) if you report credit card fraud, and the disputed amount does not need to be paid or sent to collections during the investigation.

What should I do if I encounter a billing error or dispute?

If you encounter a billing error or dispute, first contact the merchant and if that doesn’t work, file a dispute with your card issuer within 60 days of the transaction. Remember to act promptly to address the issue.