Did you know that you could be wasting money on unknown subscriptions? According to a survey commissioned by C+R Research, 30% of consumers are not aware of about half of the recurring expenses in their bank accounts and statements.

Indeed, automatic payments have several advantages. After all, you can conveniently get services without thinking about manually paying your upcoming bills.

However, the downside to this model is that you can easily lose track of how much you’re already paying. Your monthly charges may seem small, but they can quickly rack up to a serious amount.

So, if you want to know how to see all subscriptions on card, this blog post is for you. Today, we’ll show you five methods that will help you keep track of monthly subscription fees.

5 Ways to Discover Your Subscription Services on Your Credit Card

To identify the recurring charges on your monthly bills, here are five methods you can try:

Method 1: Check Your Online Bank Account

To easily access your transaction history, you can check your bank account online. Log in to your account, then go to the transaction history section. There, you will discover upcoming payments and learn more about your subscription services.

Indeed, online banking platforms give you a broad idea of your monthly charges. However, note that they do not categorize your subscription services. So, it can still be challenging to determine which ones you don’t need.

Method 2: Review Your Bank Statements

According to a 2019 Pew Research Center survey, over 30 million Americans do not have access to the Internet. So, for those who want a tangible record of their transactions, paper bank statements would be ideal.

Do you prefer reviewing a physical copy of your financial accounts? If so, get about three months’ worth of your bank statements.

Highlight charges that repeat every month. Doing so will help you identify regular payments for various memberships or streaming services.

Quick Note: Remember that some bank companies charge a fee for paper statements. So, check with your provider if you’d have to pay for paper bill delivery.

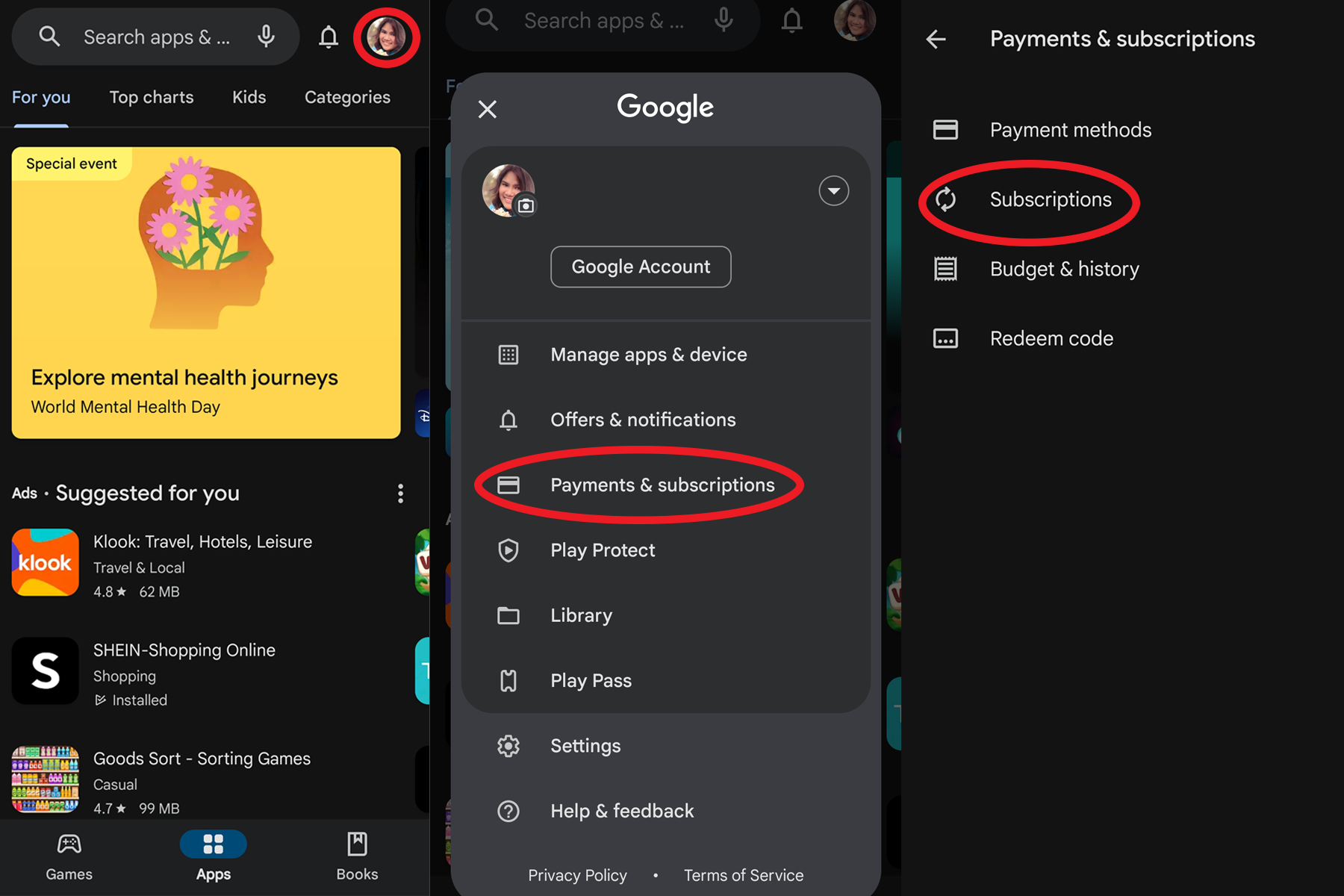

Method 3: Check Your Subscriptions on Android

Keep in mind that this method will only help you identify recurring subscription charges for mobile apps. If that is your goal, follow these steps:

Launch the Google Play Store on your mobile device.

Go to your profile photo -> Payments & subscriptions -> Subscriptions

From here, you can select a subscription service. You can either pause your payments or cancel the subscription.

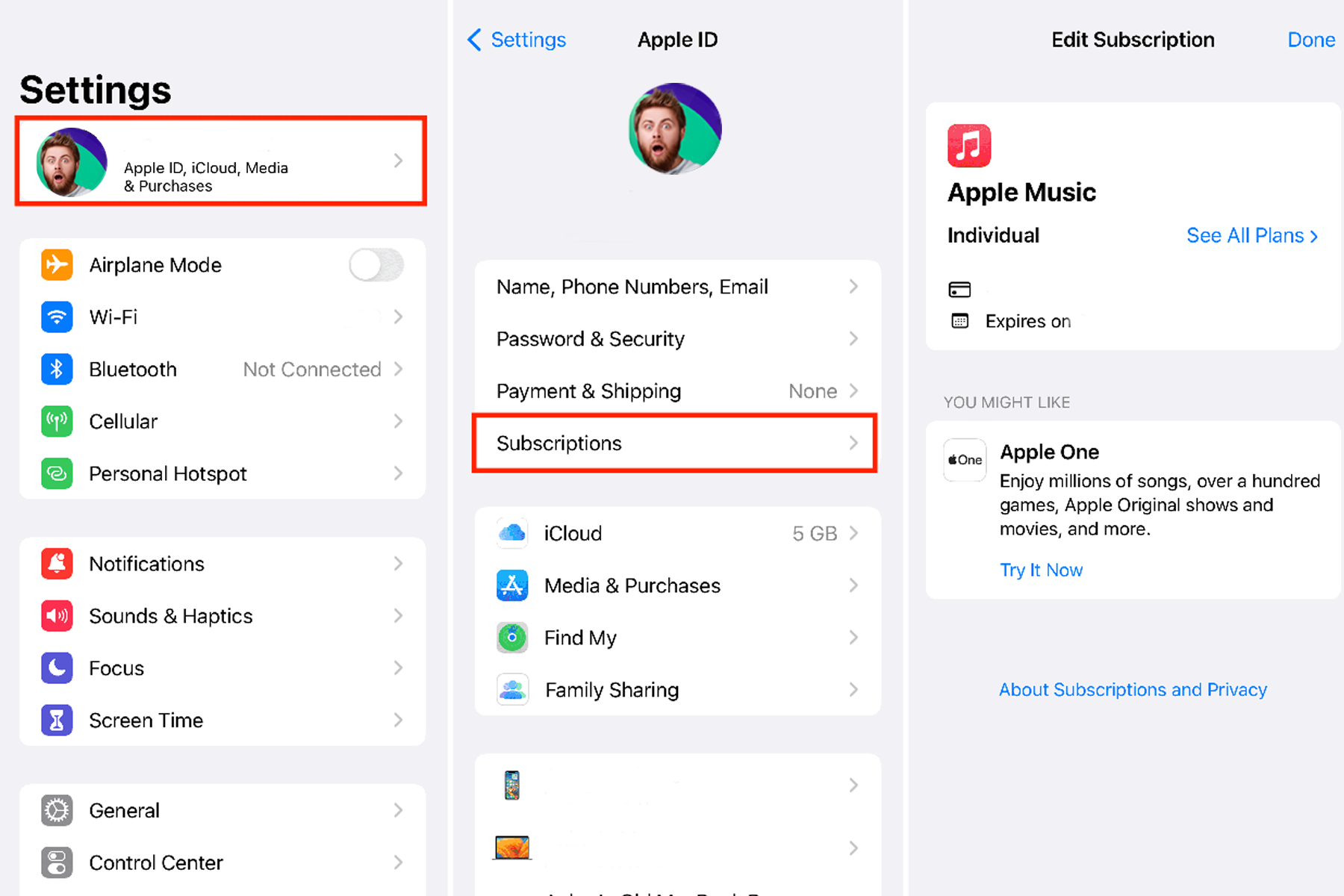

Method 4: Check Your Subscriptions on iOS

Do you want to determine your subscription services on the Apple App Store? Here are the steps:

Launch the Apple App Store and tap your initials or profile photo.

Go to Subscriptions or access Settings -> Subscriptions.

You will see your active and expired subscriptions, and you can sort them according to price, name, billing date, or renewal date. If you want to see more information about the service, you can tap it. Moreover, you can renew inactive subscriptions.

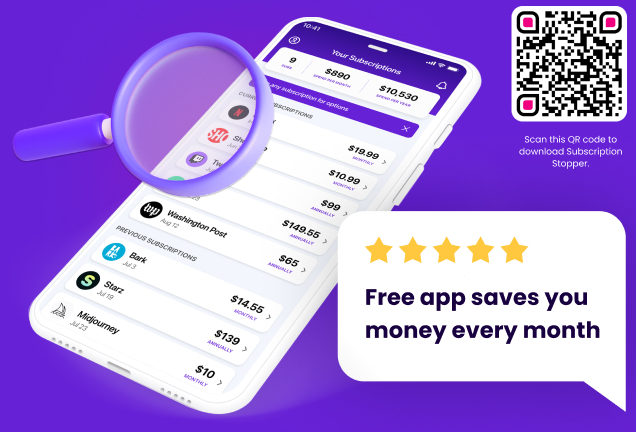

Method 5: Manage Subscriptions with Subscription Stopper

While online banking and paper statements let you access your transactions, they are not the best methods for managing your subscriptions. You’d have to sift through numerous pieces of information before you can identify recurring subscription expenses that you don’t need. Meanwhile, managing subscription services via Google Play and the App Store provides limited details.

Now, if you want an easier way to manage subscriptions and cancel recurring fees, your best bet is to use Subscription Stopper. All you need to do is download the app and connect your bank or credit card accounts. The app will track your subscriptions for you.

You will see details of every service, including how much you’re paying monthly and annually. Moreover, the app lets you identify the subscriptions or memberships that take up the biggest percentage of your monthly bills.

The best part is that Subscription Stopper is completely free! You don’t have to pay a fee just to upcoming bill dates and cancel your subscriptions!

Tips for Saving Money on Subscriptions

According to a 2023 NerdWallet survey, while most Americans have a monthly budget, 84% admit to overspending. So, if you want to become more responsible for your finances, you can clean up recurring payments that you don’t need.

We recommend thoroughly evaluating your current subscriptions and memberships. At the same time, you can use various budgeting strategies, including resource allocation, split subscription costs, and fee negotiation.

Here are some ways to save money on subscriptions:

Cancel Unwanted Services

Of course, you can save money on your credit card bills by identifying unnecessary or unused services. You can use Subscription Stopper to evaluate your monthly charges and determine streaming services and memberships that you no longer need. Moreover, you can use this app to cancel these monthly fees and save money in the process.

Quick Tip: Be sure to review the terms of your subscription agreements. Moreover, contact your credit card providers directly and ask about potential penalties for early cancellation.

Acquire a Record of Cancellations

When it comes to financial transactions, you always need to have proof. So, when you’re canceling membership or subscription charges, ask for a documented confirmation of the transaction. It could be in a physical form mailed to your address, or it could be an email. Keep a copy of the confirmation, which you can use in case you’re charged for a canceled service.

Negotiate Subscription Costs

According to a 2018 survey, 85% of cardholders were successful when they tried to negotiate bills. So, if you want to save money on subscriptions, we recommend contacting your service providers and negotiating lower rates.

When you become proactive in managing your subscriptions, streaming service providers and other membership-focused companies will likely help you. In most cases, these businesses are willing to let you save a significant amount on subscription costs to keep your loyalty.

Set up Calendar Reminders

Are you fond of signing up for free trials? Perhaps you subscribed to a service that renews every six or 12 months. If so, remember to set up a calendar reminder a few days or weeks before the renewal date. This way, you’ll easily track payment dates and have enough time to cancel the service.

Go Through the Fine Print

A 2017 Deloitte study found that 91% of consumers agree to terms and conditions without reading them. You don’t have to be part of that unknowing percentage. So, before signing up for any subscription service, make sure that you go through the fine print carefully. Check if you’ll be charged a recurring or flat fee.

Check for Cancellation or Reactivation Charges

If you’re planning to cancel a membership or subscription early, you might deal with specific fees. Remember that gym memberships and cellphone contracts usually have lock-in contracts. The same goes for reactivating a previously canceled subscription. So, we recommend contacting the provider directly and asking about these charges.

Set Up Credit Card Alerts

It wouldn’t hurt if you took some time out of your day to review your credit card statements. However, there’s an easier way to check gray, recurring charges. You can set up credit card alerts to inform you whenever a transaction gets posted in your account. Moreover, you can customize payment reminders to send messages whenever an activity exceeds a set amount.

Once you receive these alerts, you can log into your online banking account to review these charges. Check if these are fees that you agreed to.

Choose the Convenient Way to See and Manage all Your Subscriptions

If you want to have a healthy financial life, you must manage your subscriptions effectively. Indeed, you can set up calendar reminders and even create budgeting tools on a spreadsheet.

However, if you want an easier way to manage recurring fees on your card, your best bet is to use a subscription management app like Subscription Stopper.

By getting insights into your membership and subscription fees, you’ll have better control over your finances. Moreover, you will make informed decisions about your everyday spending habits. Besides, the app notifies you when new subscriptions are billed to your account.

So, stop wasting money on unnecessary services and download Subscription Stopper today!

Frequently Asked Questions

How can I see all my subscriptions on my card for free?

Log in to your credit card’s online portal to view all transactions and look for any recurring payments or charges that indicate a subscription. Doing so should allow you to easily access and review all of your subscriptions for free. However, if you want a physical copy of your credit card statement, you may have to pay a fee.

Now, if you want to review, cancel, and manage subscriptions on your card for free, the best option is to download Subscription Stopper. This app is 100% free to download, use, and keep. Once you connect your cards, you can keep tabs on all of your subscriptions.

How do I cancel unwanted subscriptions?

To cancel unwanted subscriptions, search through emails for any subscriptions, then email the credit card issuer to cancel them. If you’re unable to locate them, go through bank statements back for 12 months and look out for any forgotten or fraudulent regular subscriptions.

As you can see, manually canceling unwanted subscriptions takes a lot of time. If you want to identify and cancel unnecessary credit card charges quickly, your best option is to use Subscription Stopper.

What are the benefits of using subscription tracking apps?

Subscription tracking apps offer a convenient way to manage your finances by providing an organized view of all your subscriptions, saving you time and helping you stay on budget.

How can I manually track my subscriptions?

Keep track of your subscriptions manually by creating spreadsheets or setting calendar reminders to ensure you don’t miss a payment date.

Are there any differences between managing subscriptions on Android and iOS devices?

Yes, there are differences in managing subscriptions on Android and iOS devices. After all, each platform has its own device-specific settings and app stores for managing subscriptions for premium users.

Will subscriptions cancel if I cancel my card?

Before canceling your credit card, make sure to transfer to another account any subscription information linked to it. Otherwise, automatic payments like gym memberships, streaming services, or utilities will fail.

Also, don’t expect these services to stop the moment you cancel your card. Some providers would continue charging your account a few weeks or even a month after you fail to pay them.

Do subscriptions continue if you get a new card?

As long as you update your account information and link your new credit card, your memberships and services will continue.