Let’s face it—budgeting is not a fun activity. According to Ramsey Solutions’ State of Personal Finance report, about 30% of Americans are struggling with their personal finances. However, if you want to manage your money wisely, you need to establish and follow a monthly budget. Thankfully, budgeting apps make that process a lot more convenient.

Now, if you’ve been using budgeting apps for a long time, you’re probably familiar with Intuit Mint. This program has been a fan favorite since 2006. However, with Credit Karma acquiring the company, users will soon be migrated to a new home.

Now, if you don’t like this move, it may be high time to find the best alternative to Mint. Today, we’ll share other budgeting apps that will help you manage your spending habits and lifestyle. We’ll help you find the program that will support you in your financial goals.

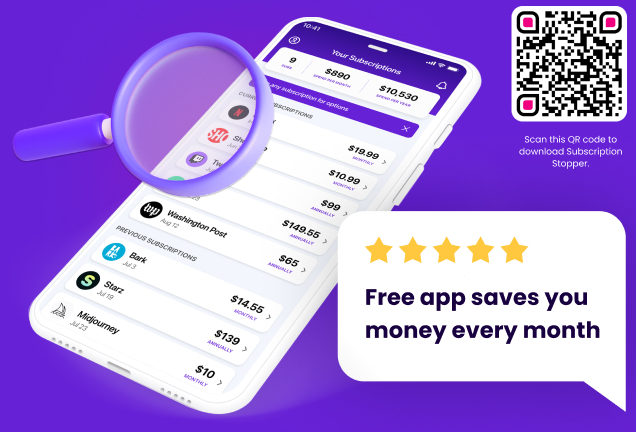

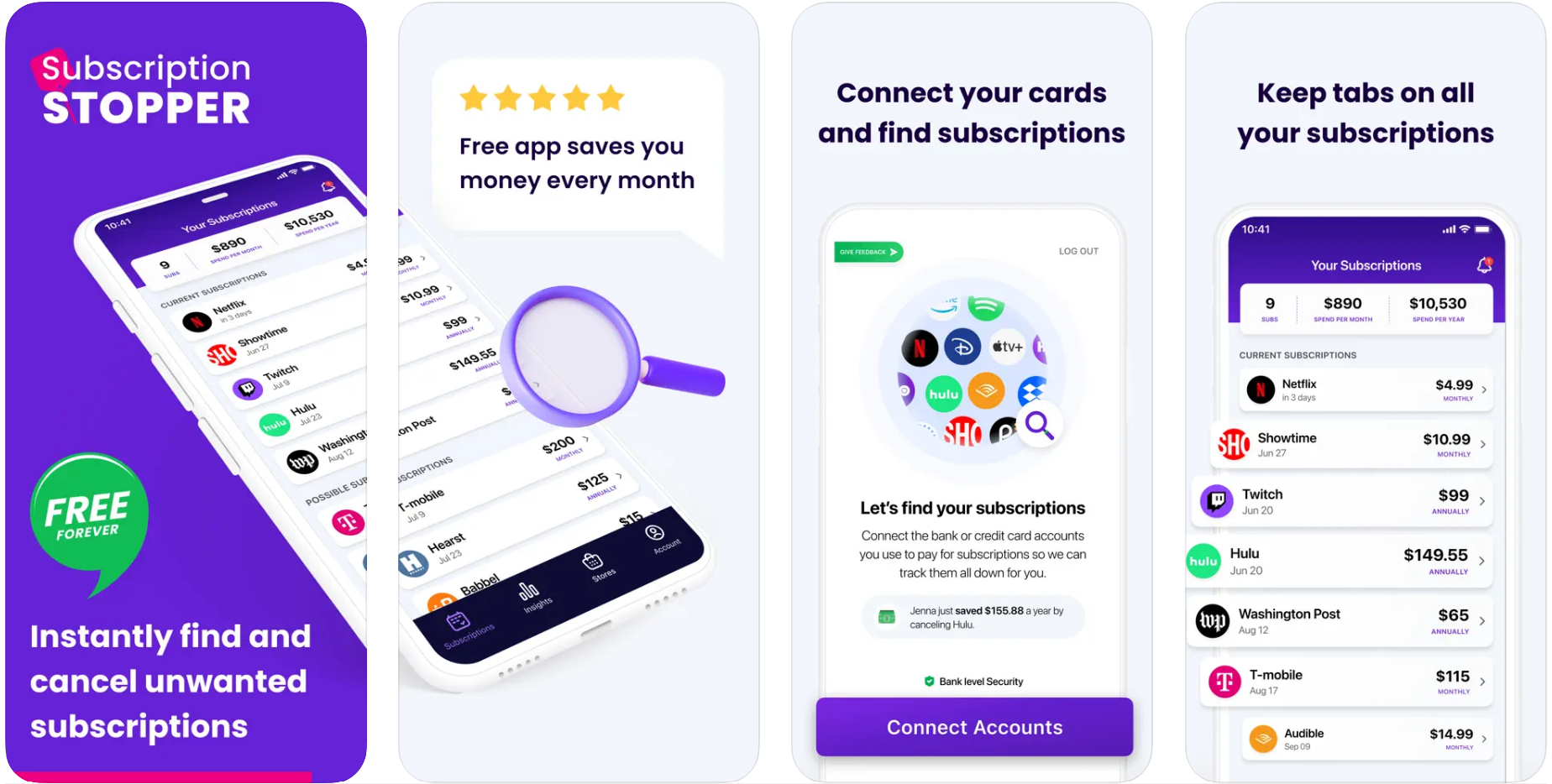

1. Subscription Stopper – The Best Mint Alternative for Identifying Forgotten Subscriptions

Did you know that 74% of consumers easily forget about their recurring subscription charges? So, if you’re not the type who goes through every detail in their bank statements, you’re likely wasting money on services you no longer use. While these monthly charges don’t seem much, they can quickly pile up. Besides, free trials eventually become hidden subscriptions if you don’t cancel them in time.

Thankfully, there is a Mint alternative that can help you identify these forgotten subscriptions easily. You can use Subscription Stopper to see recurring payments that you no longer need. Moreover, this app gives you insights into how much you’re unnecessarily spending every month and every year. All you need to do is connect your cards. The tool will generate a report of all your subscriptions. Within a few clicks, you can cancel these unnecessary services and gain control over your finances.

Subscription Stopper Features:

Automated subscription monitoring

Reports for hidden recurring payments

Transaction analysis for all your bank accounts

iOS and Android apps

Easy subscription cancellation

Subscription Stopper Pricing:

Subscription Stopper is the only subscription management app that is absolutely FREE!

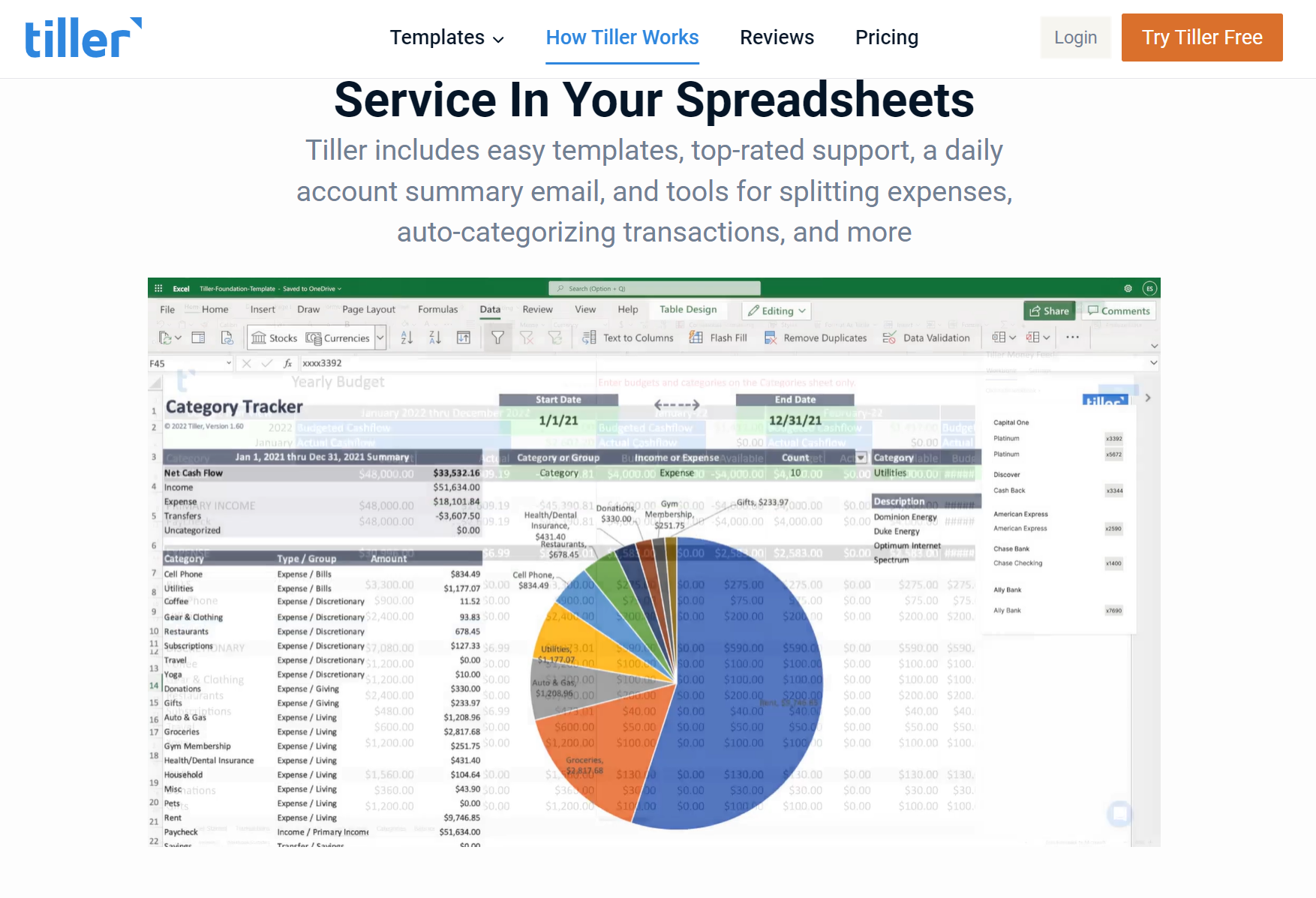

2. Tiller Money – For Spreadsheet-Focused Budgeting

If your goal is to manage your finances, one of the best Mint.com alternatives for you is Tiller Money. You can connect your credit cards, bank accounts, and even investment portfolio to this program. Then, you can view your finances as an Excel spreadsheet or Google Sheet. Moreover, you can access various tools and templates that will let you monitor your spending and manage your budget.

Tiller Features:

Centralized tool for tracking your financial accounts

Templates for creating your budget and monitoring your spending

Two-factor authentication

Automatic categorization of expenses

Tiller Pricing:

30-day free trial

$79 per year

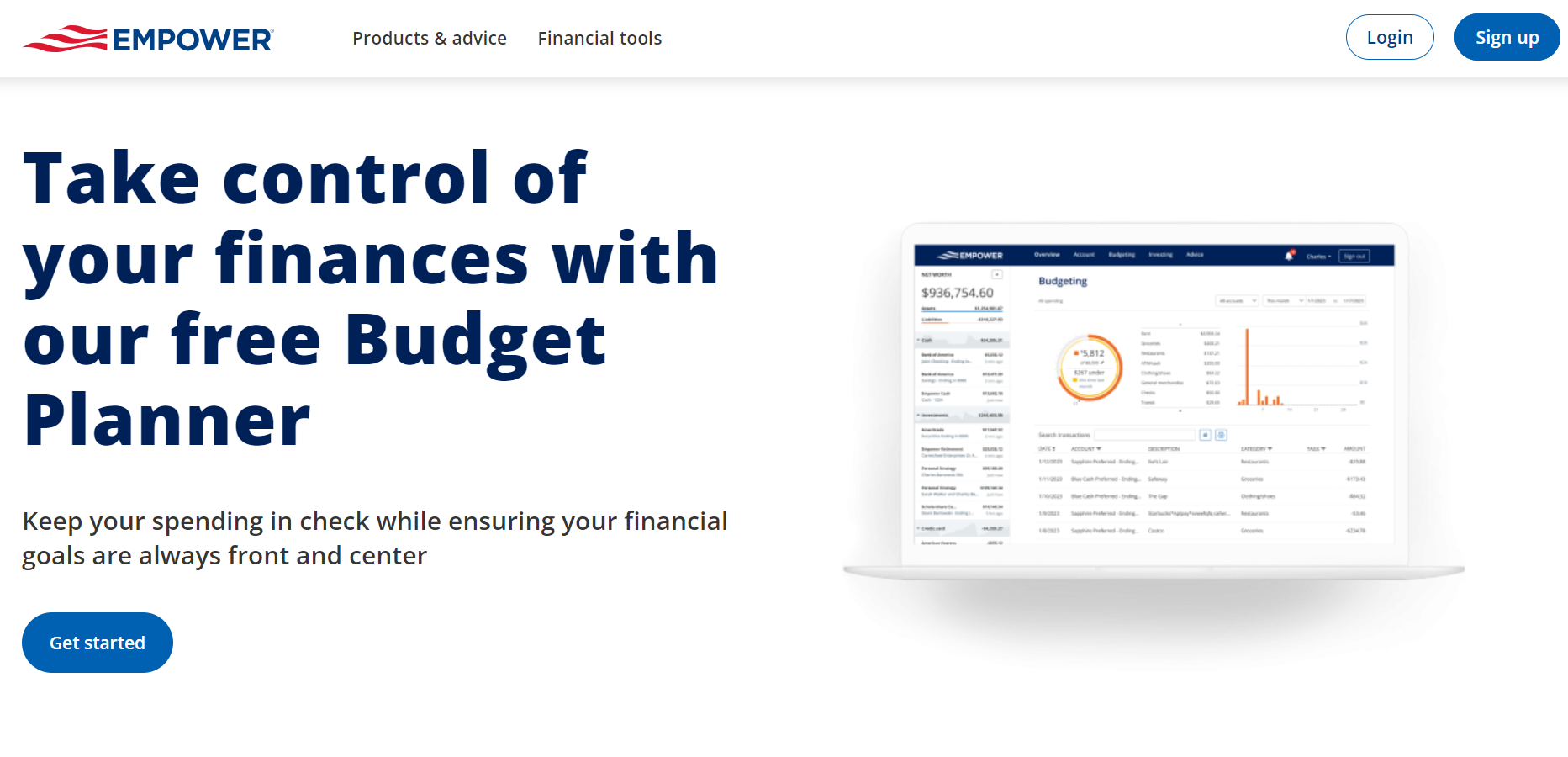

3. Empower – For Budgeting Your Current Finances to Your Retirement Plan

Compared to Mint, Empower has more tools for monitoring your finances and analyzing your investment and net worth. Once you’ve linked your financial accounts to the app, you’ll see insights into your financial data and bank accounts on the dashboard. You can access Empower on your computer, smartphone, or tablet. Besides, it has an intuitive user interface. So, you’ll quickly learn how to navigate the features.

Empower Features:

Alerts for bill due dates

Portfolio asset allocation

Net worth monitoring

Insights into your cryptocurrencies

Empower Pricing:

Free

Investment management services at 0.89% of your money (accounts below $1 million)

4. Quicken – For Helping You Increase Your Savings

If you want to take control over your finances and augment your savings, Quicken is among the best Mint.com alternatives. Trusted by individuals and organizations, this software program has comprehensive tools for financial management. Quicken is primarily a desktop app. However, if you prefer working on your smartphone or tablet, you can use Quicken’s mobile budgeting app, Simplifi.

Quicken Features:

Smart tracking for managing your spending and increasing your savings

5GB Dropbox storage

Customizable features for personal, property, or business management

Real-time spending alerts and financial reports

Quicken Pricing:

Quicken Personal

Classic for Mac and Windows – Deluxe ($2.99 per month); Premier ($4.19 per month)

Simplifi (Mobile and Web App) — $2.39 per month

Quicken Business

Classic Business and Personal for Windows — $5.99 per month

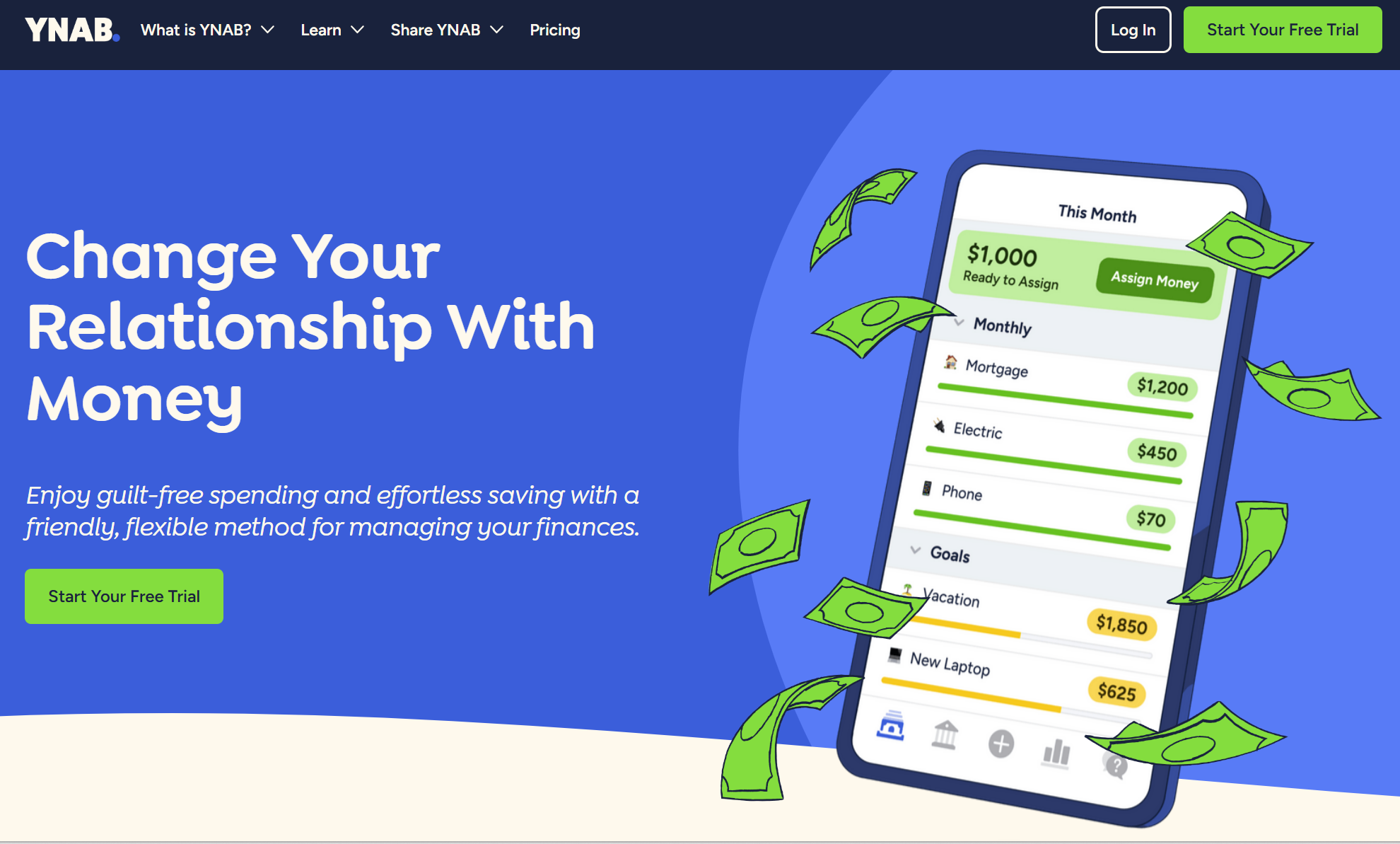

5. YNAB (You Need a Budget) – For Planning Your Future

You Need a Budget or YNAB claims to help users make better financial decisions that will get them out of debt, save more money, and stop living from paycheck to paycheck. The company prides itself in teaching people practical budgeting by following four rules:

Give every dollar a job

Embrace your true expenses

Roll with the punches

Age your money

YNAB has the features to support these rules, allowing new users to save about $6,000 in their first year. The app is available on Windows and macOS, as well as on iOS and Android.

YNAB Features:

Real-time insights on spending habits and expenses

Over a hundred live workshops for additional financial management support

Budgeting reports, graphs, and charts

Bank-grade data encryption and two-factor authentication

YNAB Pricing:

34-day free trial

$99 per year or $14.99 per month

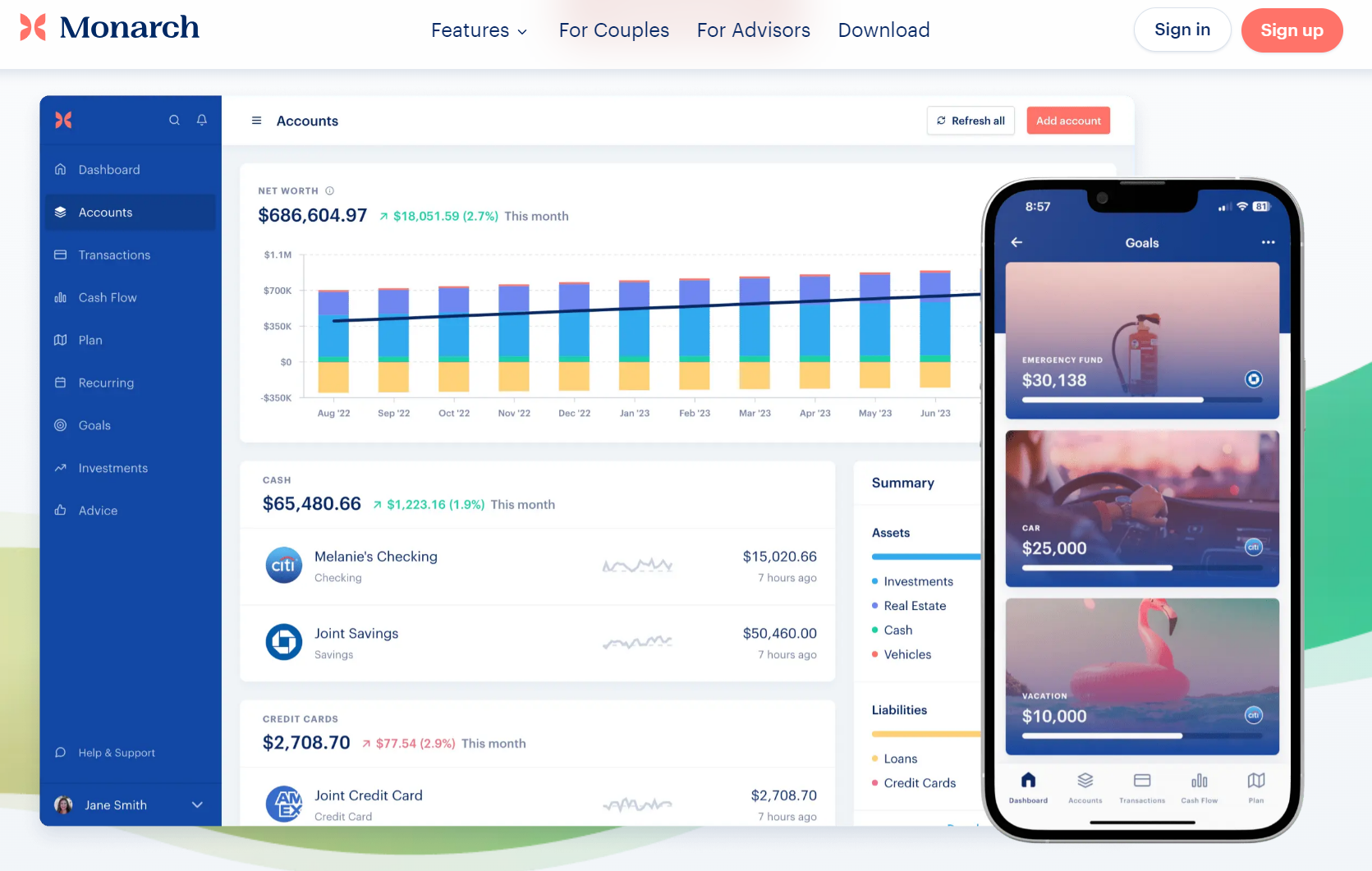

6. Monarch– Budgeting App for Couples

Monarch is among the best Mint.com alternatives for various reasons. For one, you can expect an intuitive user interface. Once you get to the dashboard, you can quickly access your financial details. You can compare your spending habits and expenses against your monthly budget. Moreover, you can review your net worth and monitor your financial goals. While you can use Monarch on your computer, you can also access it on your mobile device.

Monarch Features:

Net worth syncing to give couples a complete picture of their financial data

Investment tracking tools

Budgeting tool for setting up financial goals like property purchase or retirement fund

Spending and expense reports

Monarch Pricing:

7-day free trial

$14.99 per month or $99.99 per year

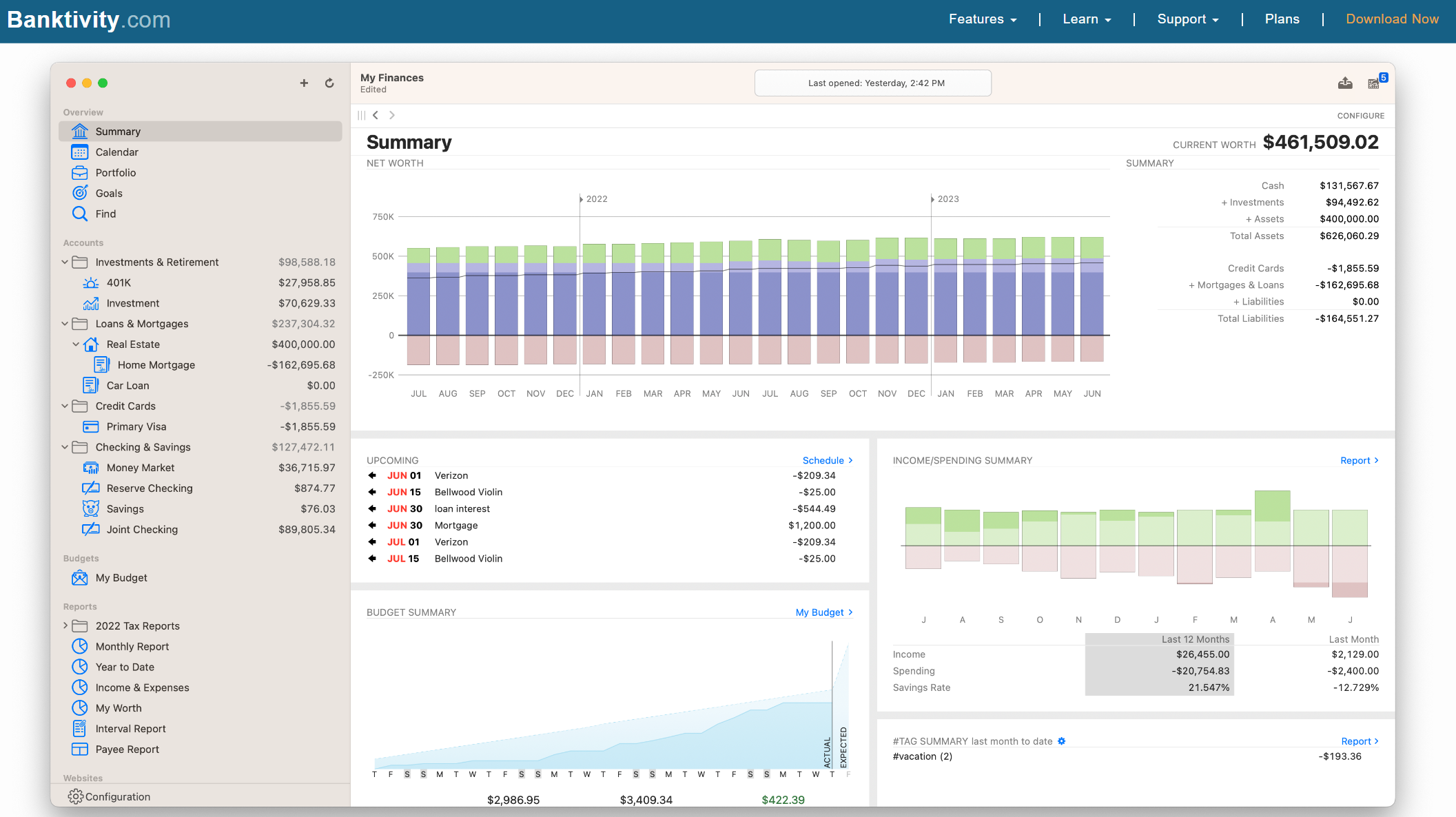

7. Banktivity – For macOS and iOS users

If you’re looking for Mint.com alternatives designed explicitly for macOS and iOS, consider using Banktivity. Formerly known as iBank, this intuitive personal finance app has been around for over a decade. Moreover, Banktivity takes pride in providing service without infringing on people’s privacy. The app allows users to use digital envelope budgeting or zero-based budgeting, which involves financial planning based on what a person currently owns. They can access the dashboard to learn how they can plan for the future based on their assets, liabilities, and monthly income.

Banktivity Features:

Multiple currencies for easier cash transfers

Quicken import plug-in

Customizable reports, categories, budgets, and file management

Access to various types of accounts, including investment, savings, debt, and cash flow

Banktivity Pricing:

30-day free trial

Bronze Subscription – $4.17 per month or $49.99 per year

Silver Subscription – $5.84 per month or $69.99 per year

Gold Subscription – $8.34 per month or $99.99 per year

8. CountAbout – For Importing Data from Mint

If your biggest worry is the heaps of data you need to transfer from Mint, consider getting CountAbout. It comes with a feature that lets you import your entire Mint history and net worth conveniently. Besides, this program doesn’t bombard you with advertisements. Moreover, you can use it to consolidate your bank transactions and categorize income and expenses.

CountAbout Features:

Automated download of financial transactions

Receipt attachments

Mint or Quicken plug-in for easier data import

Reports for recurring transactions

Small business invoicing

Customizable spending and income tags and categories

CountAbout Pricing:

45-day free trial

Standard – $9.99 per year

Premium – $39.99 per year

Take Control of Your Finances Today

We can all agree that budgeting can be stressful, which is why many try to avoid it. However, if you want to better personal finance management, you must review your cash flow, expenses, and investment portfolio. Using a budgeting tool can be a good start, and identifying recurring payments you no longer need can be the next step. However, learning how to cancel your Netflix subscription or other monthly services is easier said than done.

If you want a convenient way to find and cancel hidden subscriptions, use Subscription Stopper!

Frequently Asked Questions About the Best Mint Alternatives

Q: What is the best alternative to Mint?

Some of the best Mint alternatives include Quicken, Empower, and Tiller. Now, if your primary goal is to get rid of recurring charges you no longer need, Subscription Stopper is what you need. On its free financial dashboard, you will get a summary of your subscriptions. Moreover, you can identify hidden recurring fees and cancel services within a few clicks.

Q: Is there a completely free budgeting app?

Many budgeting tools offer a free version with limited features. However, if you want to access complex personal finance tools like investment tracking, you’d have to subscribe to the paid version.

Q: Is Mint the best budget software?

Many users claim that Mint is the best app for investment tracking and financial management. However, the tool is soon migrating user data to Credit Karma. So, if you’re not a fan of this move, it’s time to look for the best Mint alternatives.

Q: Is Mint 100% safe?

While Mint is not completely foolproof, it uses the best security technology in the industry. It relies on 128-bit SSL encryption and third-party security monitoring.