Introduction

Ah, TransUnion, the guardian of our credit secrets, the keeper of our financial histories. In a world where your credit score can be the golden key to your dreams or the anchor dragging you down, TransUnion stands tall, offering a beacon of hope with its credit monitoring services. But, as the saying goes, “all good things must come to an end,” and sometimes that includes our journey with TransUnion. Whether you’re tightening the old budget belt or simply looking to simplify your life, you might find yourself whispering, “It’s not you, TransUnion, it’s me,” as you ponder how to part ways. Fear not, for I’m here to guide you through the maze of canceling your TransUnion membership, ensuring your credit report doesn’t throw a tantrum in the process.

Before we dive into the nitty-gritty, let’s take a moment to appreciate the role of credit monitoring in our lives. It’s like having a financial guardian angel, always keeping an eye out for you, making sure no sneaky identity thief or erroneous charge puts a dent in your credit armor. But when the time comes to spread your wings and fly solo, knowing how to gracefully exit the stage is crucial. So, buckle up, buttercup, as we embark on this journey of financial independence, armed with knowledge and a sprinkle of humor to keep things light.

How to Cancel TransUnion Membership

Canceling your TransUnion membership might feel like you’re trying to break up with a clingy partner—it can be tough, but it’s all about knowing the right buttons to push. So, let’s get down to brass tacks and walk you through the process, step by step, ensuring you can part ways with your credit monitoring service without any unnecessary drama.

Online Cancellation Process

Log In to Your Lair: First things first, you’ll need to dive into the digital depths of the TransUnion website. Arm yourself with your username and password, because you’re going to need to breach the gates by logging into your account.

Navigate the Maze: Once you’re in, it’s like being in the control room of your financial spaceship. Look for the “Account” or “Membership” section; that’s where the magic happens. This is where you’ll find the elusive “Cancel Membership” option, hiding like a shy creature in the underbrush.

The Final Countdown: Clicking on “Cancel Membership” might give you a moment’s pause—after all, you’re about to cut ties with your credit monitoring comrade. But fear not! You’ll likely be met with a barrage of “Are you sure?” messages, each one a desperate plea to keep you in the fold. Stay strong, my friend, and proceed.

Confirm Your Escape: You’ll probably have to confirm your cancellation more times than you confirm your pizza toppings on a Friday night. It’s all part of the process. Once you’ve assured TransUnion that you are, indeed, ready to fly solo, you’ll finally hit that “Confirm Cancellation” button.

The Parting Email: Keep an eye on your inbox, as TransUnion will send you a digital farewell letter, confirming your membership cancellation. It’s like the closure you need to move on, a final adieu from your credit monitoring journey.

Phone Cancellation Process

Dialing for Freedom: If navigating the digital realm isn’t your cup of tea, you can always go old school and use your trusty phone. The TransUnion customer service team awaits your call, ready to guide you through the cancellation process.

The Human Touch: Speaking to a real-life human can be reassuring, especially when you’re making financial decisions. They’ll walk you through the steps, offer you alternatives, and, when all is said and done, process your cancellation request.

Confirmation is Key: Just like with the online process, you’ll receive a confirmation of your cancellation. This time, it might be verbal, but you can also request an email confirmation for your records.

Whether you choose the path of clicks or the road of conversation, canceling your TransUnion membership is a straightforward process. It’s all about taking that first step and following through, ensuring your credit report remains unscathed in the process.

Understanding Your TransUnion Credit Report

Diving into your TransUnion credit report can feel like opening a treasure chest of your financial history, with each line of credit, each account, whispering tales of past financial escapades. But fear not, intrepid explorer, for understanding this map is key to navigating the seas of your financial well-being.

Your TransUnion credit report is a detailed ledger, a comprehensive account of your credit history, including every loan you’ve danced with, every credit card you’ve romanced, and even those pesky inquiries from lenders peeking into your financial soul. It’s like the financial diary you never knew you were keeping, meticulously recorded by the scribes at the credit reporting agency.

The Heart of Your Financial Identity

At the core of your credit report lies your personal information—your name, address, and sometimes even your employment history, standing like the pillars of your financial identity. This section is the cornerstone, ensuring that all the credit data aligns with the right individual.

The Chronicles of Your Accounts

As we delve deeper, we encounter the accounts section, a detailed record of your credit accounts, both past and present. This is where your financial relationships come to life, each account telling its own story through balances, payment histories, and the status of each account. It’s a testament to your reliability as a borrower, a reflection of your punctuality and dedication in repaying debts.

Inquiries and Public Records: The Plot Twists

No tale is complete without its twists and turns, and in your credit report, these come in the form of inquiries and public records. Inquiries, those instances where lenders have requested a peek at your credit, can be voluntary or involuntary, each leaving a small footprint on your credit history. Public records, on the other hand, are the dramatic chapters—bankruptcies, tax liens, or court judgments, each a significant event that has left its mark on your financial narrative.

The Impact of Canceling Your Membership

Now, you might wonder, “What happens to this epic when I cancel my TransUnion membership?” Fear not, for the story of your credit does not end here. Your credit report continues its journey, with or without credit monitoring. The difference lies in the vigilance, the constant guardian that credit monitoring provides, alerting you to changes, potential fraud, or errors that might sully the pages of your financial tale.

Canceling your TransUnion credit monitoring subscription doesn’t erase your history or alter your credit score directly. However, it does mean that you’ll need to be the captain of your own ship, navigating through the waters of your credit history with a keen eye for changes and discrepancies.

As we close this chapter, remember that your credit report is a living document, a narrative that continues to evolve with every financial decision you make. Understanding its contents, its structure, and its significance is crucial in steering the ship of your financial future towards prosperous shores.

The Importance of Regular Credit Reports

In the grand tapestry of your financial life, each thread represents a decision, a moment, a transaction that shapes the overall picture. Regularly reviewing your credit reports is akin to stepping back and examining this tapestry, ensuring that every thread is in its rightful place, contributing to a harmonious and accurate representation of your financial history.

The Beacon of Financial Vigilance

Think of your credit report as a lighthouse, guiding the ships of potential lenders, landlords, and even employers towards the shores of your financial reliability. Regular checks are the light in this lighthouse, illuminating the path, revealing any rocks of inaccuracies or waves of fraudulent activities that might jeopardize your journey.

The Ripple Effect of Credit Health

Your credit report is more than just a record; it’s a reflection of your financial health, influencing the terms of loans, the rates of mortgages, and even the premiums on insurance policies. Like ripples in a pond, every entry in your credit report can expand, affecting various aspects of your financial life. Regular monitoring ensures that these ripples are positive, propelling you towards your financial goals rather than away from them.

Navigating Post-Cancellation Waters

So, what happens when you decide to cancel your TransUnion membership? The lighthouse doesn’t crumble; the light doesn’t extinguish. You still have the right to access your credit reports, thanks to the Fair Credit Reporting Act, which entitles you to a free copy of your report from each of the three credit bureaus once every twelve months. Websites like AnnualCreditReport.com serve as vessels, allowing you to navigate these waters, ensuring you can still keep a watchful eye on your financial landscape.

The DIY Approach to Credit Monitoring

In the absence of a credit monitoring service, the responsibility of vigilance falls upon your shoulders. It’s a DIY project of sorts, where you become the artisan of your financial well-being. Setting reminders to check your credit reports, reviewing each account, and disputing any inaccuracies becomes your craft, ensuring that the tapestry of your financial life remains a masterpiece.

Regular credit reports are the compass by which you navigate the sea of your financial life, ensuring you stay on course, aware of your surroundings, and ready to correct the course whenever necessary. They are an indispensable tool in your financial toolkit, one that remains crucial, with or without a credit monitoring service.

Alternatives to TransUnion Credit Monitoring

In the vast universe of credit monitoring, TransUnion is but one star among many, illuminating the path to financial awareness and security. However, when the time comes to explore new galaxies, knowing the constellations of alternatives can guide you to a service that resonates with your unique financial narrative.

The Spectrum of Credit Monitoring Services

The market is teeming with credit monitoring services, each offering its own blend of features, from basic credit report updates to intricate analyses of your financial habits. Services like Credit Karma, Experian, and Equifax provide similar offerings, with some providing the added allure of free services, peppered with insights and recommendations to enhance your credit health.

The DIY Galaxy: Self-Monitoring

For those who prefer to captain their own ship, the DIY route of self-monitoring is a rewarding journey. Armed with annual free credit reports from the three credit bureaus, you can chart your own course through the financial cosmos. This approach requires diligence and a keen eye for detail, as you’ll be the sentinel guarding against inaccuracies and fraudulent activities.

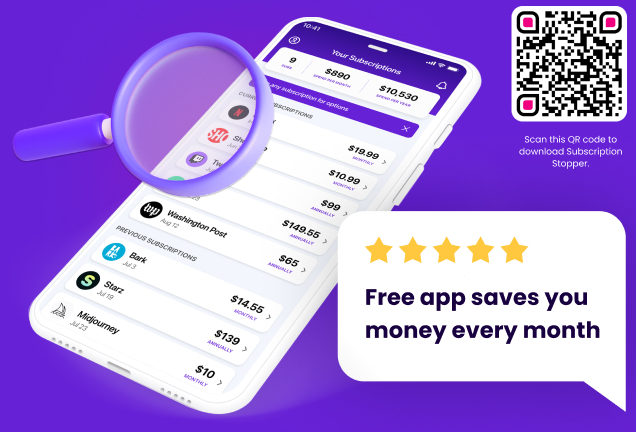

Apps and Tools: The Technological Companions

In this digital age, a plethora of apps and tools stand ready to assist in your credit monitoring quest. Apps like Mint and Credit Sesame offer not only credit monitoring but also a holistic view of your financial health, integrating budgeting tools and personalized financial advice, all at your fingertips.

Niche Services: Tailored for the Individual Stars

For those with specific needs or concerns, niche credit monitoring services offer tailored solutions. Whether you’re rebuilding your credit, safeguarding against identity theft, or simply seeking more personalized advice, there’s likely a service designed with your situation in mind. These specialized services often delve deeper into the nuances of credit management, offering a more bespoke experience.

The Community Approach: Credit Unions and Local Banks

Sometimes, the best guidance comes from your local community. Many credit unions and local banks offer credit monitoring services to their members, often at competitive rates or even for free. These institutions can provide a more personal touch, with advice and services tailored to the local economic landscape.

As you consider the vast array of alternatives to TransUnion credit monitoring, remember that the best choice is the one that aligns with your financial goals, habits, and preferences. The universe of credit monitoring is vast and varied, offering a constellation of options to guide you on your journey to financial enlightenment and security.

What to Consider Before Canceling

Before you decide to cut ties with your TransUnion credit monitoring subscription, it’s like standing at a crossroads in your financial journey. There are signposts pointing in different directions, each leading to potential outcomes that could shape your credit health. Let’s ponder over a few crucial considerations to ensure you’re taking the path that best serves your financial well-being.

The Safety Net of Credit Monitoring

Think of your credit monitoring service as a safety net, gracefully unfurled beneath the tightrope of your financial activities. It’s there to catch you, to alert you of any missteps like identity theft or inaccuracies that could send your credit score tumbling. Before you decide to walk this tightrope without a net, consider the peace of mind it offers, especially in today’s digital age where financial fraudsters lurk in the shadows.

The Ripple Effects on Your Credit Health

Every action in the realm of personal finance creates ripples, some of which can touch the shores of your future financial opportunities. Canceling your credit monitoring might seem like a small pebble tossed into the pond, but its ripples can extend to your awareness of credit report changes, your readiness to address inaccuracies, and your vigilance against potential fraud.

The Alternatives: Charting a New Course

Before you bid farewell to TransUnion, have you charted a new course? Exploring the alternatives, as we’ve discussed, is akin to scanning the horizon with your financial telescope, seeking new stars to navigate by. Whether it’s another credit monitoring service, a DIY approach, or leveraging free tools and apps, ensure you have a new compass in hand before you set sail from the familiar shores of TransUnion.

The Cost-Benefit Compass

In the grand voyage of personal finance, your budget is your compass, guiding your decisions and ensuring you don’t veer into the stormy seas of financial strain. Weigh the costs of your TransUnion subscription against the benefits it provides. Is the peace of mind, the instant alerts, and the detailed analysis worth the gold coins you’re parting with each month? Or can these funds be charted towards other financial goals on your map?

The Timing: When Stars Align

In the celestial dance of financial decisions, timing can be as crucial as the decision itself. Are there looming financial ventures on your horizon, like applying for a mortgage, a car loan, or even a new job? In such times, having a vigilant eye on your credit can be invaluable, ensuring your credit report is in shipshape, presenting you in the best financial light.

As you stand at this crossroads, pondering whether to continue your journey with TransUnion or to venture down a new path, consider these signposts carefully. Your decision not only affects your financial present but also the horizons of your financial future.

FAQ Section

Embarking on the journey of canceling your TransUnion membership might stir a sea of questions in the ocean of your mind. Fear not, for we shall navigate these waters together, answering the sirens’ calls that beckon with queries about this significant decision. Let’s set sail and explore the most common inquiries that might echo in the halls of your thoughts.

Can I cancel my TransUnion membership at any time?

Yes, you can drop the anchor and cancel your TransUnion credit monitoring subscription whenever you feel the winds of your financial journey changing direction. However, remember that the timing of your cancellation might affect the remaining days of service you have left in your current billing cycle. It’s like leaving a party early; you want to make sure you’ve had your fill of the festivities (or, in this case, the services) before you say your goodbyes.

Will canceling my membership affect my credit score?

Rest easy, for canceling your TransUnion membership is akin to changing the sails on your ship; it doesn’t alter the course of the waters beneath. Your credit score remains untouched by this decision, continuing to ebb and flow based on your financial activities, not your subscription status with a credit monitoring service.

How Can I continue monitoring my credit after cancellation?

Even after you’ve parted ways with TransUnion, the voyage of monitoring your credit must go on. You can hoist the sails towards other credit monitoring services, embrace the DIY approach with annual free credit reports from the three major credit bureaus, or employ a fleet of financial apps and tools designed to keep a watchful eye on your credit health. The seas of credit monitoring are vast, with many ships ready to take you aboard.

Are there any cancellation fees?

In the realm of TransUnion, the act of canceling your membership is free from the shackles of cancellation fees. Your financial ship can set sail from TransUnion’s harbor without parting with any additional gold coins. However, it’s wise to confirm this as you navigate through the cancellation process, ensuring no hidden fees are lurking in the waters.

With these questions answered, the fog on the horizon clears, revealing a path forward, illuminated by the knowledge you’ve gained. Whether you choose to continue your journey with TransUnion or chart a course towards new credit monitoring shores, you’re now equipped with the insights to navigate these decisions with confidence.

Conclusion

As we dock at the final port of our journey through the intricacies of canceling a TransUnion membership, let’s take a moment to reflect on the voyage we’ve undertaken. From understanding the importance of credit monitoring to navigating the seas of cancellation and exploring the islands of alternatives, each step has been a crucial part of our financial expedition.

The Beacon of Awareness

Remember, the essence of credit monitoring, whether through TransUnion or another service, is to serve as a beacon of awareness in the vast ocean of your financial life. It’s about keeping a vigilant eye on the horizon for any changes that could signal calm seas or impending storms in your credit health.

Charting Your Financial Course

Deciding to cancel your TransUnion membership is akin to choosing a new direction on your financial map. It’s a decision that should be weighed with consideration of your current needs, future aspirations, and the ever-changing tides of your financial journey.

The Compass of Alternatives

As we’ve explored, the universe of credit monitoring is vast, with numerous stars to navigate by. Whether you choose another service, take the helm with a DIY approach, or utilize digital tools and apps, the compass of alternatives points towards many paths to safeguarding your credit health.

The Voyage Continues

Even as we conclude this guide, remember that the voyage of managing and monitoring your credit is an ongoing journey. Each decision, each action, and each inquiry is a stroke of the oar in the waters of your financial history, propelling you towards your goals.

In the grand adventure of life, managing your credit is but one chapter in your financial storybook. Whether with TransUnion by your side or charting a course with new allies, the goal remains the same: to navigate through calm and stormy seas alike, towards the horizon of your financial dreams.